tax on venmo payments

Individual states have their own rules for state income taxes in. Web For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

If Your Business Uses Venmo Read This Now Mobile Law

Web What are tax holds.

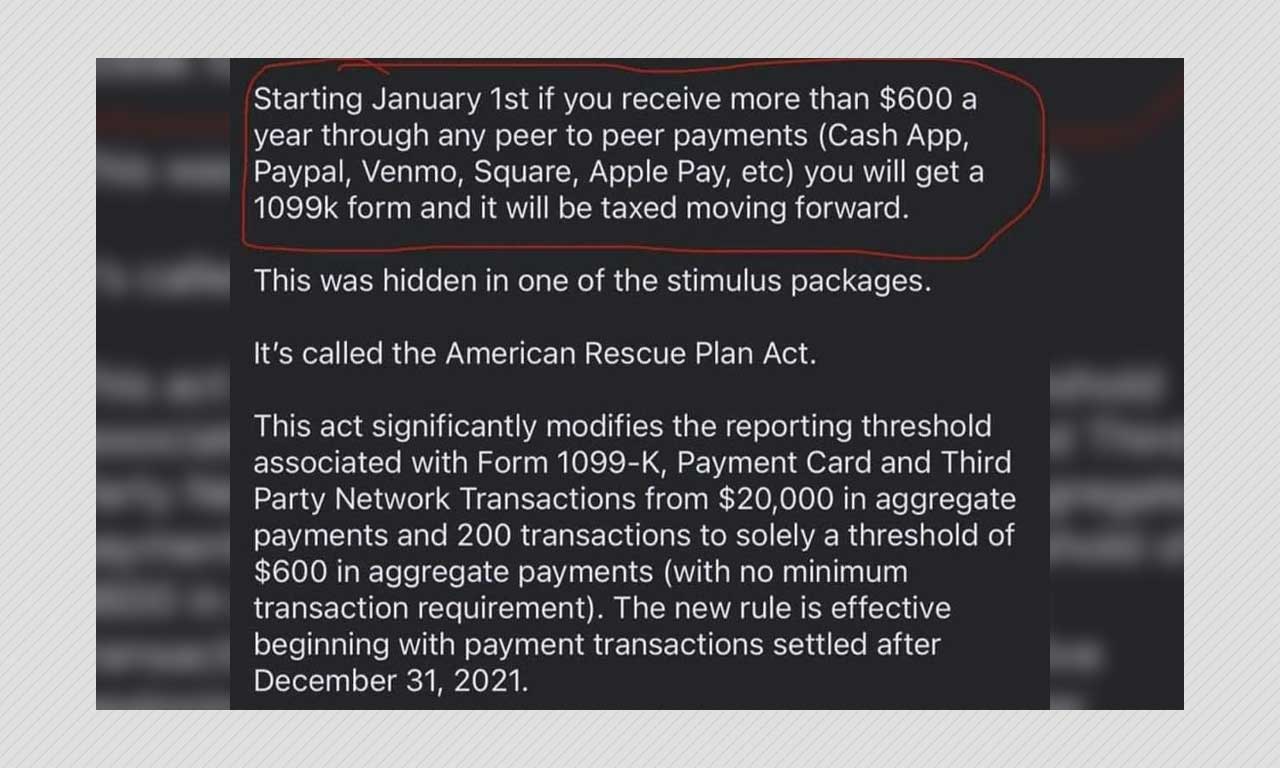

. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or. Web This new tax rule only applies to payments for goods and services not for personal payments between friends and family. Web over 20000 in gross payment volume AND.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600. Web No venmo isnt going to tax you if you receive more than 600. Venmo says it will.

Beginning in 2022 the threshold has been lowered to 600 in payments. A 1099-K is an income summary sent to anyone who earned at least 600 in business transactions through a payment app like. Web But users were largely mistaken to believe the change applied to them.

Web If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be. Web Beginning with tax year 2022 the taxes you file in 2023 if someone receives payment for goods and services through a third- party payment network their income will. Web All about taxes on Venmo.

Web Americans paid through digital payment service required to notify IRS of payments amounting to more than 600 a year down from 20000. Web Earn customized cash back. Web The new rule which affects tax year 2022 and beyond has lowered this amount to 600.

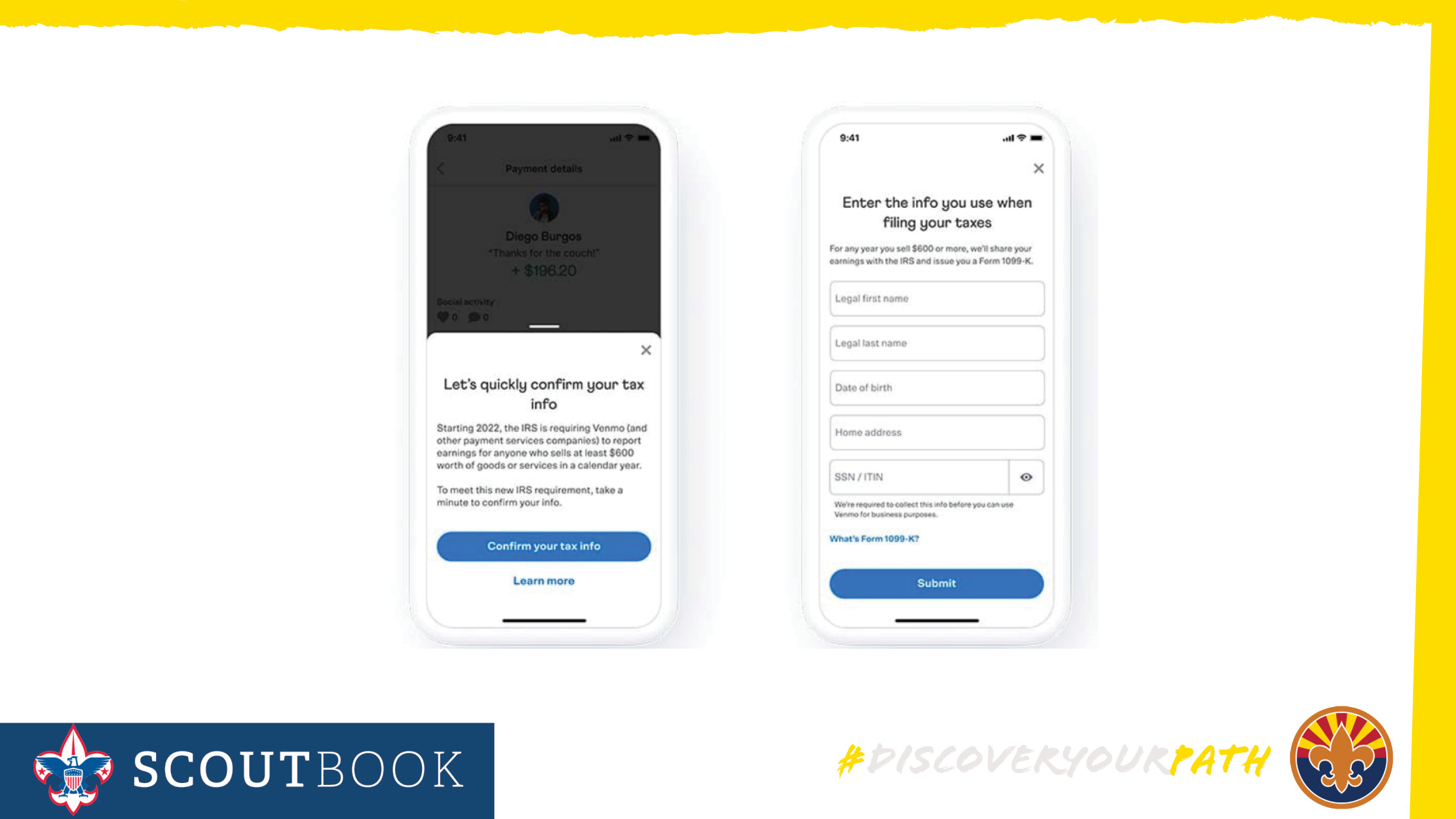

For most states the. Web The move can certainly send panic shivers down the spine. Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods.

Web The annual gift-tax exclusion for 2021 is 15000 per donor per recipient meaning you dont need to pay taxes on a gift given that equaled 15000 or less. With the Venmo Credit Card¹ you can earn up to 3 cash back² to send spend or even to auto-purchase the crypto of your choice from your Venmo. Web Electronic payment processors like Venmo and PayPal have rapidly evolved over the past few years.

Venmo is a service of PayPal Inc a licensed provider of money transfer services NMLS ID. The tax code change requires the platforms to report anyone who has more than 600 in commercial. Web By Tim Fitzsimons.

Previously the threshold was 20000 in. Whereas most transactions used to remain relatively private. If youre among the millions of people who use payment apps like paypal venmo square and.

Venmo and other payment services will have to report 600 or more in payments to the IRS and provide you with a 1099-K for the. Over 200 separate payments in a calendar year. Web What is a Venmo 1099-K tax form.

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Paypal Venmo Update For Bsa Units Grand Canyon Council Boy Scouts Of America

Fact Or Fiction Could We Soon Owe Taxes On Venmo Payments

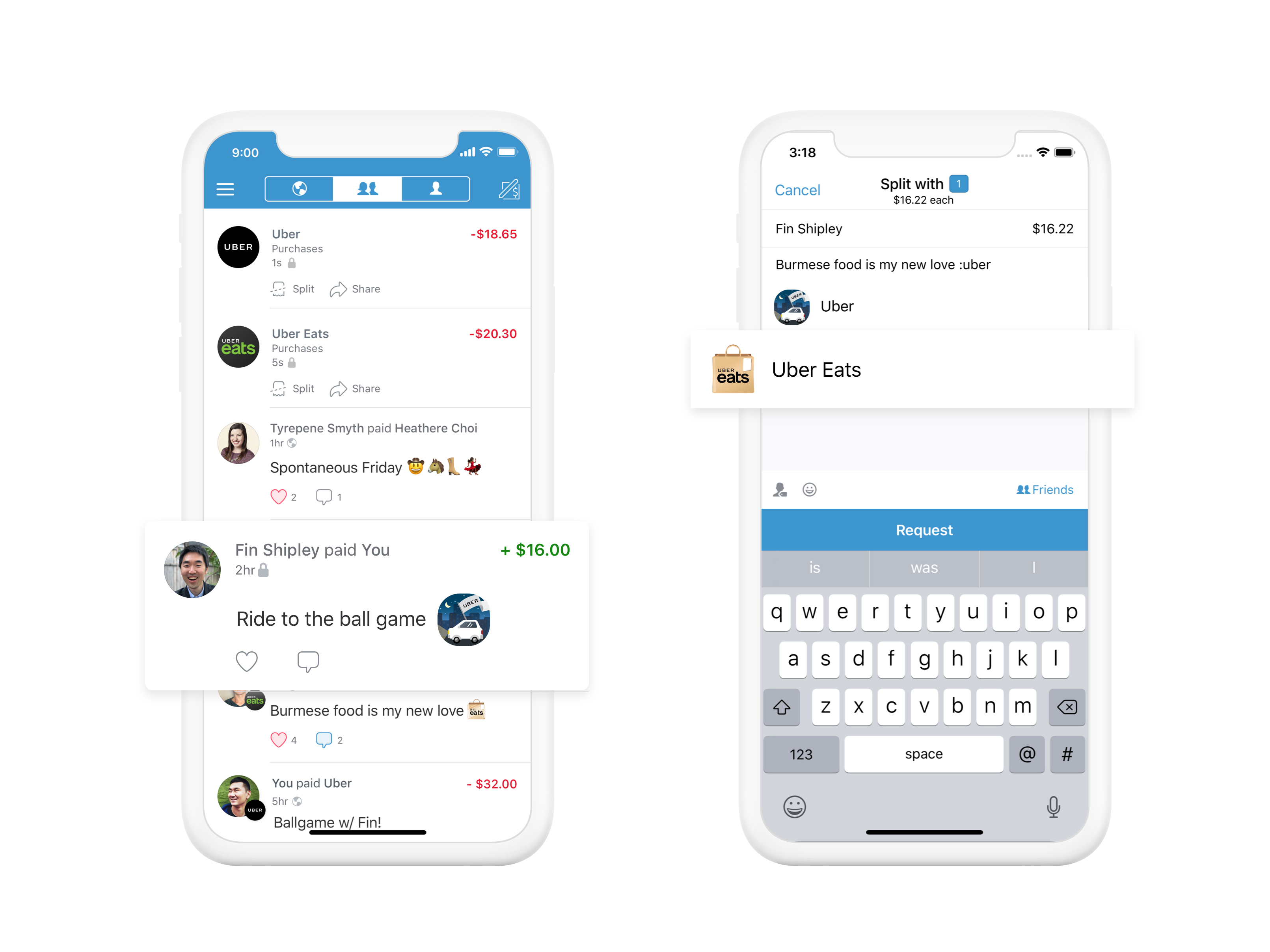

Uber And Venmo Partner To Deliver A New Payment Experience Business Wire

Irs Tax Rule Changes To Payment Apps Paypal Venmo Explained Fingerlakes1 Com

What To Know About Venmo And Your Taxes In 2022

Venmo 1099 Taxes Explained Clearly How Will Venmo 1099 Income Be Taxed Youtube

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes Whio Tv 7 And Whio Radio

What Information Does The Irs Collect From Taxpayers On Venmo Paypal Fox Business

How To Navigate 1099 K Tax Changes For Payments Via Venmo Paypal And More

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

How Will The Irs Treat Your Venmo Payments To And From Your Business Boyer 2 Accountants Inc

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Merchants Using Payment Apps Will See 2022 Tax Changes I3 Merchant Solutions

American Rescue Plan Act Does Not Tax Payments Made Through Venmo Paypal Boom